Providing a small discount in return for early payment of an invoice is not a new idea, but the concept is attracting renewed attention thanks to technological innovation and rising interest rates.

For decades, some businesses have listed discount terms on their invoices. For example, “2/10 net 30” indicated payment in full was due within 30 days, but the purchaser could save 2% on the amount due by paying within 10 days.

Now, automated invoicing systems allow suppliers to offer these kinds of discount terms with an added twist: The discount changes over time. Immediate payment results in the biggest discount, but smaller discounts are still available as time passes. Once the invoice due date arrives, the full payment amount is due.

“The incentive is to pay immediately upon receipt of the invoice— or as close as practical to that time—and take advantage of the discount,” says Greg Miles, Manager of Treasury Management Products and Services at Regions Bank in Birmingham, Alabama.

As these invoicing systems have emerged, so have real-time payments that make it easy for purchasers to take advantage of available discounts. Real-time payments can settle within seconds and come with minimal costs. Compare that to ACH, which can take two to three days to settle, or wire transfers, which typically settle within minutes but can come with high costs.

While the necessary innovations on the invoicing and payment sides of the equation grow more popular, interest rates are also changing. This raises a question about how to decide if dynamic discounting makes sense for your business.

You may have also heard the terms dynamic pricing and dynamic invoicing. Miles explains the differences like this: The capability or billing functional process is dynamic invoicing. The benefit that the invoicing delivers to a purchasing customer is called dynamic discounting or dynamic pricing. “Invoicing is the engine that makes the pricing possible, but it is the discounting that is the benefit in the end,” he says.

The Benefits of Dynamic Discounting

Dynamic discounting can benefit both vendors and purchasers.

By providing flexibility, vendors can strengthen their relationships with their key customers, which can be especially valuable in times of economic uncertainty. Vendors also gain increased choice when they offer dynamic discounting. They can set terms that make their preferred payment schedule appealing to customers.

For purchasers, agreeing to dynamic discounting and making immediate payment can reduce the cost of goods sold, potentially increasing profitability. That raises an important question for purchasers about the money saved by taking the discount.

“What the purchaser has to determine is: What are those funds competing for in terms of investment opportunities?” Miles says.

Key Dynamic Discounting Considerations

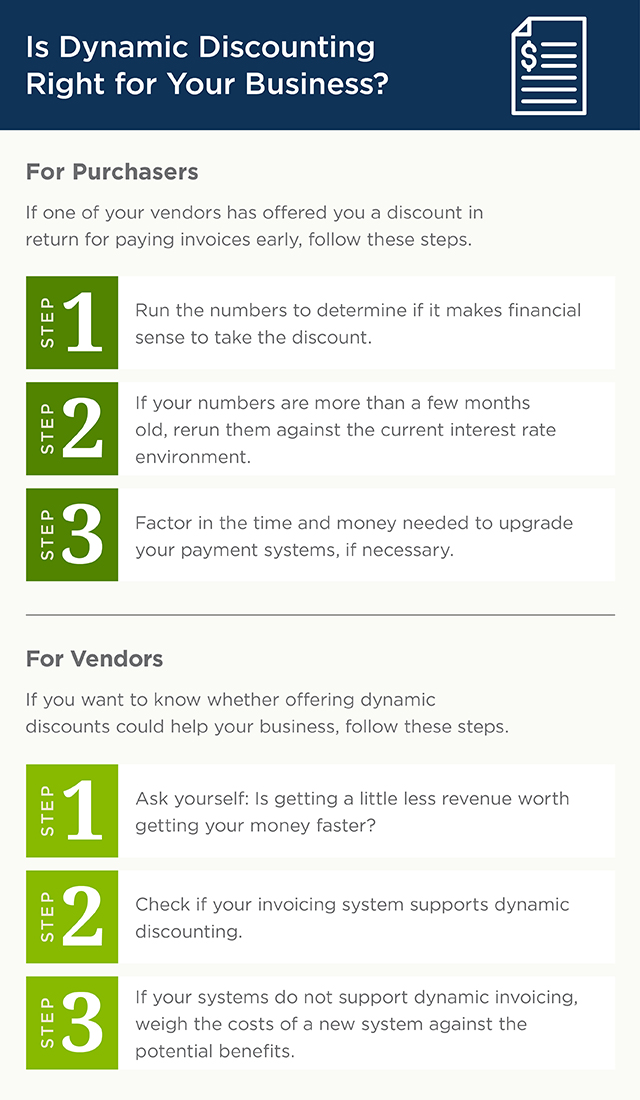

To answer that question, Miles recommends analyzing the value of the discount compared to the value of having funds available for the additional days.

“It’s important to analyze your cash flow, to know the cost of accelerating the payment versus not. Run the numbers to determine if it makes sense to take the discount, depending on the company’s cost of capital,” he says.

Even if you’ve made these calculations recently, it’s worth revisiting them now as interest rates rise, bearing in mind that early payment discounts usually range from 1% to 2%.

Purchasers should also consider any changes they will have to make to their payments systems or processes to pay early and earn a discount, and estimate what those changes could cost, both in terms of time and money.

Vendors need to analyze whether getting a little less revenue is worth getting that money faster. Vendors also need to check their invoicing system to ensure it supports dynamic discounting. Many invoicing systems don’t, and switching to one that does will come with costs that need to be weighed against the potential benefits.

Looking to Learn More?

If you’re a purchaser and already have vendors offering you dynamic discounts, Regions has the faster payment services and the advice, guidance and education you need to make optimal use of those discounts. For vendors, Regions is working on tools that make managing cash flow easy.

Contact your Regions Relationship Manager today to get guidance on dynamic discounting or to learn more about payment and invoicing tools.

Three Things to Do

- Review your list of customers and suppliers to evaluate whether there’s an opportunity to accelerate receivables or extend payables.

- Learn how to use this calculator for accounts receivable turnover.

- Read about Regions’ sweep accounts to help you earn interest on unused balances.