Many cemeteries are challenged by cash flow constraints. Learn how you can increase your income with marketing and financial solutions.

Challenging times often call for swift, innovative solutions that otherwise could have taken years to put in place — or may never have happened at all.

The COVID-19 crisis, for example, caused many of the nation’s cemetery managers to come up with new ways to include family members and friends in funeral services and burials. Some have adapted by using streaming video technologies that allow loved ones to “attend” without risking anyone’s health and safety. “The technology has been there, but with the coronavirus, it has really taken off,” says Jenny Crespo, Vice President and Relationship Consultant, Funeral and Cemetery Trust Division at Regions Bank. Crespo is a licensed funeral director and managed a large combination location prior to joining Regions.

Similarly, when interest on fixed-income investments plummeted — to levels even lower than they had been over the past few years, due to the pandemic — cemetery directors and managers found themselves pushed to seek new income opportunities to cover their day-to-day operations.

The cash flow challenge for cemeteries

Many challenges cemeteries face, however, are neither new nor likely to disappear in the near future. As more than 50% of Americans today choose cremation over traditional casket burials, cemetery revenues continue to decline. Endowment and trust income sources are also down due to low interest rates, while labor and energy costs continue to rise.

All of these trends put a huge strain on the budgets of cemeteries.

“Today’s short-term interest rates are down to almost zero, and 10-year Treasury Notes are at an all-time low. Other parts of the world are even seeing negative interest rates. So cemeteries that historically have lived off of the interest earned on the investments in their perpetual trusts are suffering financially,” says David Falconer, Senior Vice President, Funeral and Cemetery Trust Division Manager at Regions Bank.

While it’s difficult to reduce the cost of wages and employee benefits moving forward, there are ways to potentially increase investment returns for your cemetery trust and grow your income streams.

Adjusting investment strategies

“Of all the changes that cemetery owners can pursue to try to build cash flow, the one that will have the most impact is to make adjustments to the way that your trust assets create distributions to the cemetery,” says Falconer.

If you decide to try this strategy, you have two options:

1. Adopting a total-return (or unit trust) approach. This method allows cemetery owners to distribute a fixed percentage of the trust’s overall value each year — typically 3% to 5% — rather than investment income only. It may also allow for more flexibility in how the assets are invested, as long as it’s permitted by the trust.

2. Reconsidering capital gains. This approach allows cemetery owners to count gains from the sale of equity investments, including stocks, as income rather than as additional funds to add to the trust principal.

Both approaches require revising your trust documents — and the definitions of what “income” can be — and getting the change approved in states with favorable trust laws. “If your state allows the change, the annual income you have available for operations, maintenance, hiring, marketing and growing the business could increase substantially,” Falconer explains.

Offering new ways to meet consumer needs

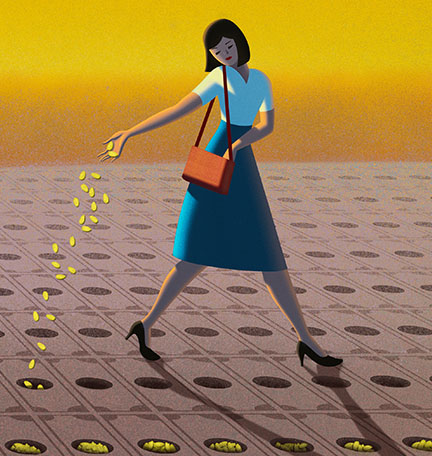

To add to the extra income that trust changes can produce, Falconer also suggests adding to the trust “corpus” by introducing new products and services that can produce alternate streams of income going forward. Those efforts may also include forging relationships with local funeral homes and churches to make sure they are aware of your products and services.

Implementing new operational and marketing strategies may help encourage customers to buy cemetery property for the future. “The definition of cemetery property may be very different than it was 20 years ago,” Falconer explains. “Back then, the property that most cemeteries were selling was a cemetery plot. Today, that real estate could be a 2-foot-by-2-foot niche in a columbarium or a granite bench that contains a loved one’s remains.”

Other services that you might consider offering include scattering gardens, where families can scatter the remains of a loved one, and alternative forms of burial like tree planting, where the deceased’s remains become part of the root ball of a tree the family can visit in the future.

“Cemeteries are definitely changing their offerings, so as cremations continue to increase, there are many more options for holding the remains of loved ones,” says Crespo. These services can give families a place to go to memorialize their loved ones on a birthday, anniversary or holiday.

“While cremation has changed the requirements for burial and the sequence of events, it’s still human nature to go through a grieving process,” Crespo explains. That’s why it’s critically important for cemetery owners to educate families about their offerings that can help memorialize and pay tribute to their loved ones.

Remember, whatever your customers decide to do, 10% to 15% of the property they purchase will go into the cemetery trust for future maintenance, so your efforts help to build the trust principal. In turn, that should increase the amount of money that can come out of the trust for upkeep and maintenance of the cemetery.

Regions Funeral and Cemetery Trust Services is a dedicated business division that focuses solely on funeral and cemetery trust needs throughout the country. Learn more about our services and capabilities.