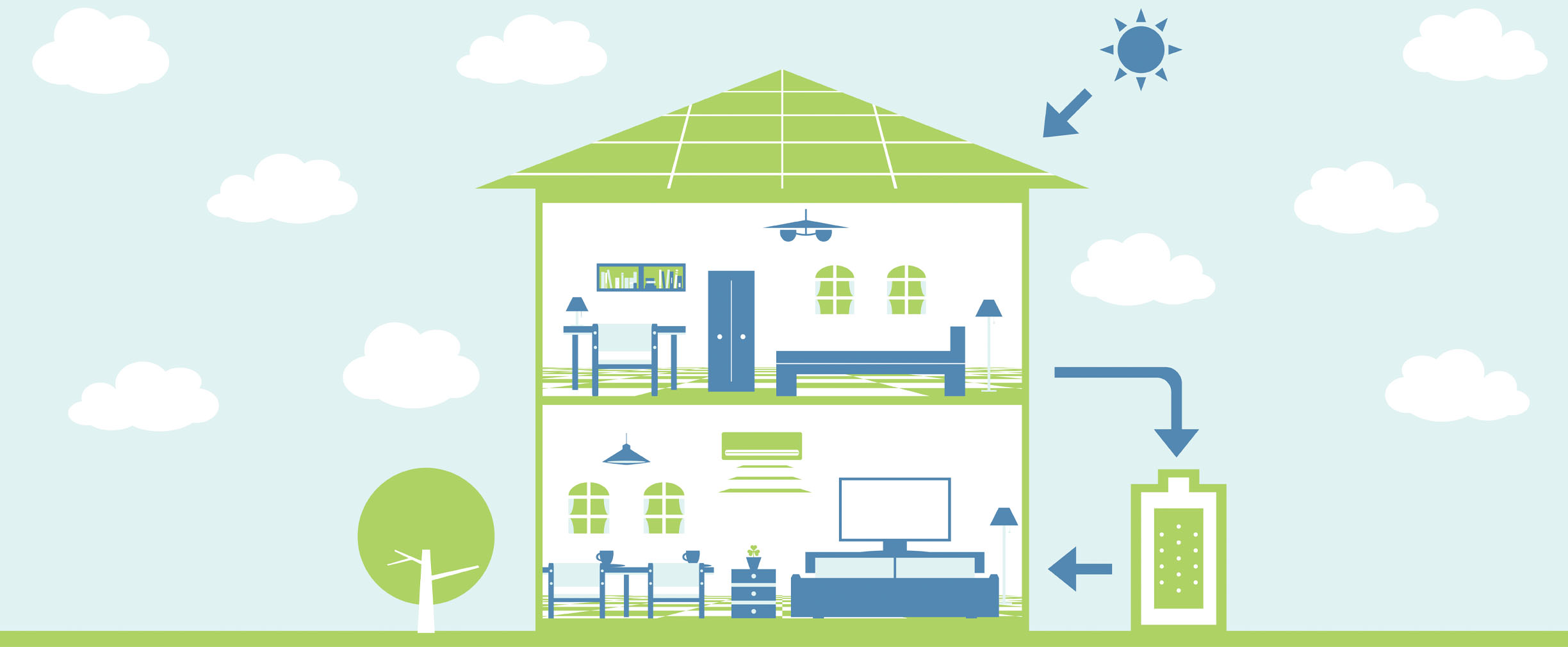

These energy-saving upgrades can save you some dough, and—bonus—they’re good for the environment.

Twenty percent. That’s how much of your energy expenses could literally be flying out the window.

The figure comes from the U.S. Department of Energy (DoE), which estimates that of the $2,000 the average American spends on energy each year, $200–$400 could be wasted due to drafts, air leaks and outdated heating and cooling systems.

That 20% adds up over time. But here’s the good news: With some home improvements, you could keep that money in your pocket—and be eco-friendly in the process.

Why now is a smart time for upgrades

Spending money on home improvements now to reap a future payoff can make sense, especially if you’re expecting to live in the same home for a while.

And energy-efficient upgrades are having a moment. It’s a trend driven mainly by two factors, says Gina Jernigan, manager of the independent contractor division at EnerBank, a division of Regions.

First, higher interest rates and a low housing inventory have made moving a challenge, so more people are staying put. “Before interest rates went up, our loans had an average life span of three to five years,” says Jernigan. “Today, they’re much longer.” After all, it used to be easier to refinance or sell your home and pay off the loan.

More homeowners are recalibrating their plans and “taking factors like the long-term savings of energy-efficient upgrades into consideration in a way they haven’t before,” says Jernigan.

The second reason is resale value, which owners can increase by upgrading a home’s energy efficiency. Over the past decade, says Jernigan, studies have shown sale and resale price premiums in most markets ranging from 2% to 8% for energy-efficient homes.

In other words, it’s a great time to start clawing back some of those energy costs.

Where to find energy savings

Here’s what Jernigan and others say are some of the most common—and effective—upgrades to consider.

- Appliances. Switching to efficient ENERGY STAR-certified appliances can have a significant impact on your utility bill. For example, a certified washing machine could save you $550 over its lifetime.

- Insulation. Sealing leaks and adding insulation can save an average of 15% on heating and cooling costs each year, according to the EPA.

- Energy-efficient windows. While windows aren’t cheap, they can cut an average of 12% off your energy bill—a savings of $100–$600 per year, depending on the climate you live in and how many windows you have.

- High-efficiency HVAC. Whether it’s room air conditioners, central air, geothermal heat pumps or other parts of HVAC systems, switching to ENERGY STAR-certified equipment can cut 10%–30% of your energy bill each year.

- A smarter home. Smart thermostats—possibly the “best candidate to save energy in your home,” according to the DoE—can cut up to 10% of your heating and cooling bill. And LED light bulbs, which may have motion detectors or be operable with your smartphone, use at least 75% less energy and last up to 25 times longer than traditional incandescents.

How to finance it

Of course, realizing these savings means making some purchases and paying for labor—and these upfront costs may be daunting.

One thing that can help: federal income tax credits. You can claim up to $3,200 annually, which can lower certain costs by up to 30%. Talk to your accountant or a tax professional to ensure your project qualifies.

To get the job done, you may need a loan. Fortunately, the process can be easier than you may think, especially if you hire a contractor who works with EnerBank.

“All our loans are designed for home improvement,” says Jernigan, who added that many of their loans fall within the $5,000–$12,000 range, though they can go higher or lower depending on your needs. And EnerBank loans come with several upsides:

- The loan is unsecured. It doesn’t use your property as collateral.

- EnerBank offers different types of loans, and you can work with your contractor to pick one that best fits both the size and budget of your project. One of the most popular options is a same-as-cash loan, which gives you six, 12 or 18 months to pay back what you borrowed before you have to make any interest payments. So if you’re waiting for, say, a tax refund or a work bonus—or you want to keep your money in a high-interest savings account a while longer—you have the option of doing so and then repaying the loan without spending a dime in interest, as long as you don’t go past the six, 12 or 18 months you agreed to.

- You can apply for the loan and be approved through your contractor, right from home, in just minutes.

So get to work, and you may start seeing your energy bills drop.

Start today

- Read more: How to boost your home’s eco-friendliness—and save money.

- Learn more: Listen to our Financing home improvements podcast.

- Take action: Read more about construction and renovation mortgage loans.