While our daily headlines tend to focus on high-profile cases of fraudulent activity impacting large corporations, it may be surprising that nonprofit organizations are even more susceptible to this particular crime.

Nonprofits are here to serve. They often do so on tight budgets with small staffs who are laser-focused on fulfilling missions and enriching communities. But in today’s world, nonprofits are often targeted by criminal entities who see them as soft targets with sensitive information about donors and constituents. Indeed, a recent study by the Association of Certified Fraud Examiners (ACFE) shows that nearly one out of 10 nonprofits are victims of fraud every year, with an average loss of $75,000.

Nonprofits have the potential for higher fraud risk than for-profit companies because nonprofits often lack the financial and human resources to protect against such malfeasance. Nonprofits are under pressure to deploy money and human capital as efficiently as possible. This can lead some nonprofits to be reluctant to expend the necessary resources on fraud protection, resulting in nonprofits being a target of fraud.

Safeguarding recommendations

At Regions, we recommend the following steps to take to ensure long-term safety:

- Guard your house with IT best practices

- Create Associate and Volunteer Training Programs

- Create a Fraud and Risk Governance Plan

Other Best Practices:

- Implement board oversight

- Encourage employees to speak up if unusual activity is noticed

- Review your current control environment

- Create ongoing monitoring procedures

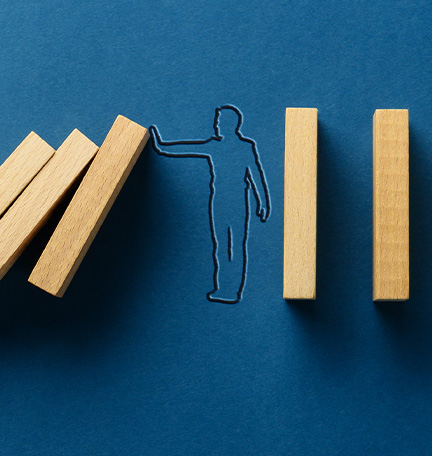

Nonprofits provide essential services to support our communities and they do so by dedicating nearly all their resources to their mission. Despite their critical missions, nonprofits are not immune to fraud.

Given the financial and reputational risks associated with fraud, it is imperative that nonprofits focus on implementing safeguards to reduce fraud risk. All efforts should start at the top so that the management team and board members are aware of the circumstances and pressures that often lead to fraudulent activity both inside and outside the organization.

“Download the full article including a fraud case study here”.

For additional tips and resources on fraud awareness and prevention, visit regions.com/stop fraud or regions.com/fraudprevention.