Discover how to protect your company’s cash from cyberattacks.

By Ivana Cojbasic, chief information security officer at Regions Bank

When you are managing cash flow, you’re likely more focused on accounts receivable and payable rather than on cybersecurity. But cyberthreats can disrupt critical business operations, lead to a loss of business-sensitive or customer-protected info and damage your reputation and brand. All of which could severely disrupt your cash flow.

Consider the actions involved in a funds transfer: sending emails or text messages, logging into a financial website or using a software application. Cybercriminals only need to infiltrate one of these critical points to attack your business.

Fortunately, you and your employees can reduce the risk of cyberthreats. Here’s how.

Watch for emerging and evolving threats

Cybercriminals love to innovate. For example, generative artificial intelligence has made it much easier to write convincing phishing emails and text messages in any language in mere minutes.

Remain vigilant about existing threats

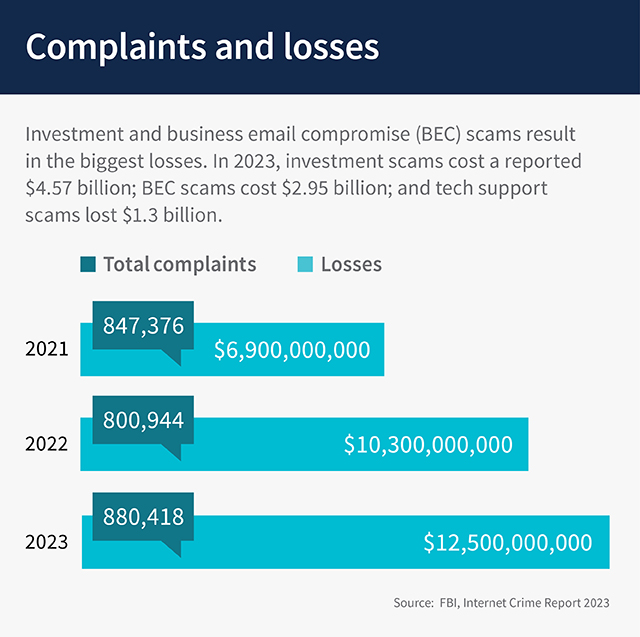

If a tactic works, cybercriminals will keep using it. Threats like business email compromise, where criminals use email to commit fraud, and phone scams have not gone away.

Implement multiple safeguards:

- Whenever possible, set up multiple factors of authentication for accounts.

- Validate transaction requests in a second channel. For example, if an email requests a funds transfer, call or text the sender at a valid number on file to confirm.

- Consider designating one bank account for outgoing payments and keep the balance low. The damage to your business can be limited.

- Give employees the lowest level of access to financial accounts necessary for them to do their jobs.

- Use bookmarked financial institution websites to help ensure you are interacting with a legitimate website.

- Consistently educate employees about threats.

The harder you make it for criminals to infiltrate your business, the better you can protect your cash flow—and your company’s future.

Start today

- Read more: 5 cybersecurity myths debunked.

- Learn more: About strengthening your remote work cybersecurity plan.

- Take action: Consider when your business may need a cybersecurity lawyer.