Talking about your company’s cash flow with a banker can create opportunities for optimization and growth.

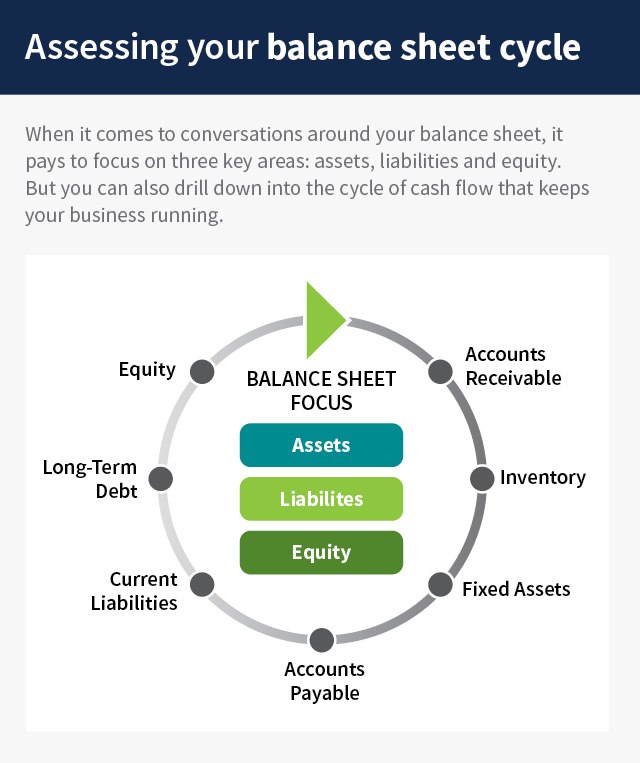

There are many tools for assessing your company’s performance. Income statements, for example, provide short-term insights about what’s fueling growth in accounts receivable and inventory. But to truly understand your company’s overall health, nothing compares to a thorough balance sheet assessment.

This is especially true when it comes to gauging your future cash needs and identifying how best to operate in the current economic environment. The reason the balance sheet is both a worthy topic of conversation with your banker and a powerful strategic tool is that it provides such a comprehensive view of your company’s cash position.

“Cash is the lifeblood of every business regardless of what the size of that business is,” says Ronnie Smith, head of the Corporate Banking Group at Regions Bank. “Cash makes payroll. Cash bridges the gap to a stronger economy where opportunities exist. It is what helps us continue to function regardless of the pressures of our industry.”

A comprehensive view of assets and debts

The balance sheet delivers a valuable view of a company’s health, challenges and opportunities because it shows the true cash position and the velocity of cash that runs through an organization.

“The more that we understand the relationship between cash, accounts receivable, accounts payable and inventory, the more we’re going to understand that individual business,” Smith says. “We are talking with our clients about how to efficiently and effectively manage working assets along with accounts payable to create a stronger cash flow and ultimately a stronger cash position.”

The balance sheet can provide the information necessary to make impactful strategic decisions or raise warning signs. Indeed, risks to a business often rise when cash levels are low. But low cash levels can also be indicative of progress. “You must really dig into the why. The answer to that why is found on your balance sheet and with your top-line revenue number,” says Smith.

For example, if the economy is booming, then you’re going to have to use cash to support the growth of receivables and inventory. Conversely, it could be a slowdown in revenue where you’re not producing as much. Or it could be that your clients are not paying you as quickly.

Turning words into action

Conversations that center on the balance sheet reveal opportunities for actions to improve your cash position and your business. For instance, reducing inventory turn by a few days moves more into accounts receivable, creating cash.

Similarly, extending accounts payable by a single day can also put more cash on the balance sheet. If a company is not taking full advantage of the terms that a supplier is providing, then they are using cash, not creating cash. If a business can extend payables for just one more day, that provides more cash on the balance sheet.

“That’s how we think about the importance of cash and cash management and the solutions that we look for, whether it’s integrated payables and receivables, or whether that’s being able to sweep excess dollars off the balance sheet for returns on idle cash,” Smith says. “It really gets back to efficient and effective cash flow management.”

An uncertain economy and its impacts on the balance sheet

What are business owners likely to see when they look at their balance sheets today? The answer is mixed and depends on the industry a company is in. High inflation over the past few years has driven prices and company revenues up. However, recent declines in inflation raise new questions for business owners. “How do I manage in a slower growth economy?” Smith says.

Companies dependent on inventory and accustomed to high demand may require operational changes as demand wanes, and potentially need to decrease inventory levels. “There’s going to be a slower burn of bringing inventory levels back down to acceptable spots, which in turn will use cash,” Smith says. “When you get cash-strapped within a company, it becomes a big pressure point.”

Preparing a balance sheet to take advantage of new opportunities

Managing falling inflation is less of a challenge for companies in certain industries because demand for their products and services is skyrocketing. For instance, companies involved with building public infrastructure like highways, bridges and electric grids are in demand. In the American Society of Civil Engineers’ most recent infrastructure report card, the U.S. received an overall grade of C-. Large investments made possible by the Bipartisan Infrastructure Law and the Inflation Reduction Act seek to bolster America’s aging infrastructure.

Companies with ample demand have different challenges—but these challenges are reflected on the balance sheet. Indeed, the ability to take advantage of new opportunities is not a given. It depends on a company’s balance sheet health.

“You can only do what you have the equity to support, and that’s the other side of the balance sheet,” Smith says. “If you have built strong equity in your business over the years, then the opportunity to access funds becomes much easier through borrowing because you have a strong balance sheet and equity position. The most successful businesses pay close attention to their balance sheet and management of their assets through multiple economic cycles.”

When it comes to conversations with a client, says Smith, “Our goal is to provide solutions that provide enough cash flow—cash improvement—that the company is able to self-finance these wonderful opportunities in front of them today.”

Making informed decisions, which can help you navigate a challenging economic environment or take advantage of new opportunities, is far more likely when they are guided by insightful balance sheet conversations with your banker. Conversations should be routine so that your balance sheet is strong enough for any scenario.

We’re here to help

You know your business better than anybody else. Surround yourself with financial managers who can extract information from you and use it to provide solutions to better your company. Your trusted local banker with deep knowledge of your industry can guide you through a cash-flow centric conversation to identify opportunities to help position you for long-term success.

Start today

- Read more: Bridging the gap: Effective cash flow sensitivity analysis.

- Learn more: Listen to a podcast on cash management strategies.

- Take action: Consider incentivizing early payments to offset cash flow challenges.