Stocks: Constructive On U.S. Large Caps Despite Concentration Concerns

July 2024

The S&P 500 returned 3.5% in June on its way to a 15.3% year-to-date total return, the index’s best performance at the mid-point of any presidential election year since 1976. The adage “sell in May and go away” has not held this time around, and we continue to expect U.S. large cap stocks to move higher throughout the summer months before volatility reenters the equation in the lead-up to the November election. A ramp-up in fiscal spending could lead to a long-awaited and most welcome improvement in market breadth as two sectors, communication services (+26%) and information technology (+28%), have generated the lions’ share of the S&P 500’s gain this year. Some signs of sector rotation were apparent in the back-half of June as capital half-heartedly moved out of the information technology sector, specifically semiconductor stocks, and found its way into consumer discretionary, energy, and financial services, among others.

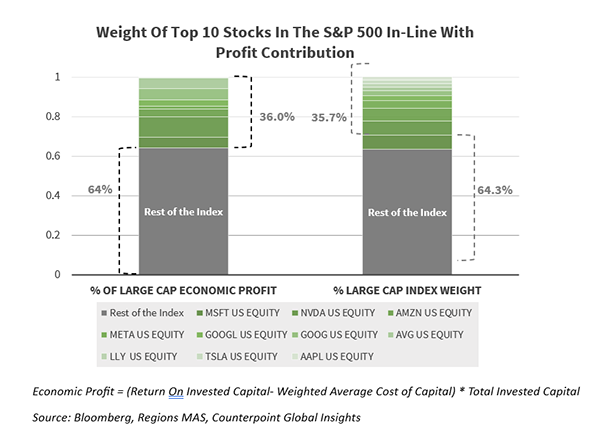

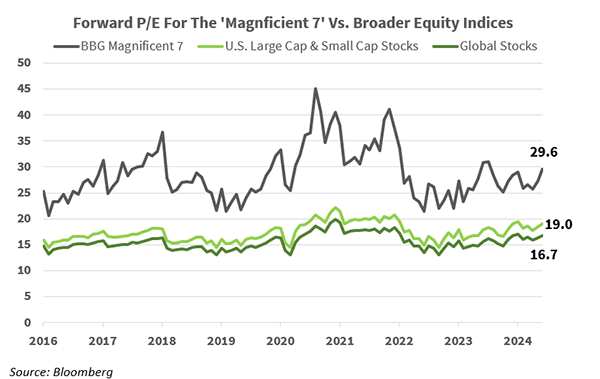

This is an encouraging development, but a few weeks does not make a trend, and with just north of 40% of S&P 500 constituents trading above their 50-day moving average at month-end, participation in June’s rally was still narrower than we would have liked. Improved price momentum out of economically sensitive sectors such as discretionary, financials, and industrials would go a long way toward alleviating some of the concerns investors have surrounding the high level of concentration within the S&P 500 as the top-10 holdings accounted for over 36% of the index at month-end. Absent better breadth, it will still be difficult for the broader market to experience a 5% or greater drawdown so long as capital continues to rotate within the ‘Magnificent 7,’ evidenced by Alphabet, Amazon, Apple, Meta Platforms, and Tesla all rallying in early July while Nvidia traded lower as it digested a sizable post-earnings rally. Index concentration is headline-grabbing but the potential for artificial intelligence (AI) to boost productivity and profitability for a broad swath of companies, not just those in the information technology sector, remains the more impactful story for stocks. As a result of this view, the S&P 500 is likely on more stable footing than a high level of index concentration might otherwise lead one to believe.

Estimate for full year 2025 S&P 500 earnings per share rose to $277.58 at the end of June, implying 14.5% earnings growth in 2025 versus 2024. Looking out to 2026, the consensus estimate has jumped to $309.20 from $303.43 at year-end, implying 11.4% earnings growth versus the current 2025 estimate. Positive earnings revisions have been the catalyst for the S&P 500’s year-to-date gain as higher forward earnings estimates and hopes for cuts to the Fed funds rate this year have allowed investors to look past lofty trailing and focus on less demanding forward valuations as the S&P 500 trades at a more reasonable 17.7 times expected 2026 profits. Upcoming quarterly earnings season kicks off this month, which along with positive earnings revisions and a Fed likely to make monetary policy less restrictive in September, should allow the S&P 500 to grow into its current valuation in time.

Small And Mid Cap (SMid) Stocks Walking A Tight Rope. The drop in Treasury yields during June should have led to improved absolute and relative performance for small and mid-cap (SMid) U.S. stocks during the month. But, instead of focusing on lower borrowing costs, investors focused more on the ‘why’ behind the fall in yields, interpreting the drop to imply that perhaps economic growth could wane over coming months, leading to a 1.8% monthly drop in the S&P 1000 SMid index. While SMid failed to rally as Treasury yields fell in June, small and mid-cap stocks could also face hurdles should rates move higher again as expected borrowing costs would likely rise. This backdrop makes for tough sledding for SMid despite what appears to be firm fundamental underpinnings and attractive valuation metrics.

One pain point for small and mid-cap indices has been the ‘promotion’ of highflying AI-related names which have graduated to the S&P 500 from the S&P 600 and 400 after sizable year-to-date rallies. This is a reminder that companies can get removed from benchmarks even after strong performance and active managers are more capable of letting their winners continue to run than are rules-based indices. The combination of macro headwinds and the reconstitution of SMid indices has provided a strong headwind for small caps as the S&P Small Cap 600 lagged the large cap S&P 500 by 16% year-to-date through June. The S&P Mid Cap 400 fared a bit better, gaining 6.2% over that time frame, still lagging the S&P 500 by a sizable margin, but besting the equal-weight S&P 500 by just over 1%.

Mid cap stocks tend to be an attractive hunting ground for active managers as the S&P 400 and other mid-cap indices tend to include companies that lack broad coverage from Wall Street firms, leading to opportunities to identify mispriced stocks. Mid-cap stocks are also attractive to investors seeking out stocks with higher betas, or leverage to a rising equity market, but with a bias toward more established, less heavily indebted firms relative to small cap indices. While the economic and interest rate environment might favor mid-caps for a bit longer, sentiment surrounding small caps is likely close to being washed out as metrics like short interest, or bets against a stock’s price rising, have risen in recent months. We do not see the U.S. economy slowing to the degree that small cap stock valuations currently imply and, given that these stocks would benefit in an outsized way from Fed funds rate cuts, we would prefer to wait for price momentum to improve before considering increasing allocations to SMid.

Less Restrictive Monetary Policy A Positive For Euro Area Stocks, But Political Risk Is On The Rise, Leaving Us Neutral. As expected, the European Central Bank (ECB) cut key policy rates by 25-basis points in early June but delivered a 'hawkish cut' as policymakers ratcheted inflation expectations higher for both 2025 and 2026 while pushing back on the prospect of additional rate cuts at upcoming meetings. The STOXX Europe 600 index tilts heavily toward cyclical sectors such as financial services, industrials, and materials, and maintains a healthy allocation to interest rate-sensitive sectors such as utilities and telecommunications as well. In isolation, lower short-term interest rates could boost economic activity, corporate profits, and investor sentiment for euro area equities. However, the ECB's ability to cut rates further over the coming months will depend upon how quickly inflationary pressures subside in the euro area and actions - or inaction - out of central banks in the U.S. and Asia. Monetary policy in the euro area is trending in the right direction, but political dysfunction across the currency bloc is on the rise as elections held in early June were destabilizing and heightened political risk/uncertainty put upward pressure on sovereign bond yields. As countries across the euro area prepare for snap elections in the coming months, economic activity could slow to a crawl despite lower interest rates, and a wait-and-see approach to euro area equities may be warranted until the political storm clouds begin to clear.

Political Risk In The Euro Area: Opportunity, Or Trap? Developed markets abroad lagged U.S. large cap stocks in June, with the MSCI EAFE index falling 1.6% during the month versus the S&P 500’s 3.5% gain. Much of the recent weakness abroad has been centered around the euro area after French President Emmanuel Macron dissolved the country’s National Assembly and surprisingly called for snap elections. Political uncertainty ramping up in France again highlights how tenuous and shaky the euro bloc’s union continues to be, and market participants ran for cover as other countries within the EU could face a similar fate over the coming months. Heightened political uncertainty in the euro area is nothing new for seasoned investors, but market participants find themselves wondering if the pullback in eurozone stocks is an opportunity to add exposure or if this is the start of a period of political unrest set to weigh on eurozone economic growth, corporate profits, and investor sentiment?

The European Central Bank further easing policy at coming meetings could be supportive of economic growth over coming quarters, bolstering investor sentiment, and leading to inflows. Political uncertainty is likely to remain heightened across the euro area even with snap elections in France behind us, but valuations for euro area stocks remain relatively appealing. Also, even a modest weakening of the U.S. dollar would be another potential positive catalyst for exporters based in the euro area. Investors reducing exposure to euro area stocks over the past month could find themselves looking to buy them back at higher prices as political storm clouds part, and with expectations for improved economic growth supported by less restrictive central bank policies underpinning our view, we maintain a neutral position.