What does the advent of generative AI mean for tech investments and other sectors?

Artificial intelligence, or AI, has become part of everyday life, making possible everything from the smart speaker that knows your favorite songs and can set the thermostat to the map app that shows you the fastest route to the beach. Yet, as remarkable as these innovations may seem, the real revolution in AI is just beginning, says Anjali Tagare, equity analyst for Regions Investment Management.

According to Tagare, the recent emergence of a form of this technology known as generative AI could be as disruptive as the rise of the internet in the 1990s and the arrival of the iPhone in 2007. “This is where all the excitement is coming from,” says Tagare. “Generative AI has the potential to touch all industries.”

Predictive vs. generative AI

The field of AI has developed gradually over the decades since computers have become mainstream, but various factors have helped it take off in the 21st century, including increased investment, the availability of greater computing power, the rise of Big Data and the advent of cloud computing.

Until recently, much of what the world knew as AI took the form of so-called predictive AI, notes Tagare. This type of AI performs statistical analysis of historical data to predict future outcomes. A familiar example is the autocomplete feature on a smartphone’s messaging app, which uses context and your past input to guess which word you are tapping out, then it flashes several choices that allow you to complete it with a single click. Predictive AI has a breadth of uses across science and industry, such as assisting with disease detection in medical imaging and analyzing past sales data to forecast customer behavior.

“This type of artificial intelligence has been used for a long time,” says Tagare. What’s causing the current buzz and excitement about this technology has been the recent emergence of generative AI, which has been in development for years but made a splash in November 2022 when it became available to the general public. The AI-powered chatbots that have since gone online accept queries (or prompts) in plain language, scan unfathomable troves of data for answers and deliver humanlike responses.

“As its name suggests, generative AI can create content,” says Tagare, noting one of the key ways that generative AI differs from predictive AI. The type of content that these chatbots generate appears to be limited only by the imaginations of users, which range from high school students using the tools to write book reports to scientists applying the technology to develop computer code or analyze the structure and behavior of proteins. Generative AI can create images, too, and some have even won art contests.

Investment opportunities in AI

Analysts suggest that the market for generative AI was about $14 billion in 2023, a figure that is expected to grow rapidly, with a compound annual growth rate of 31%, to roughly $152 billion by 2032. Generative AI can potentially spur growth in global gross domestic product by nearly $7 trillion (or 7%) over the next decade while boosting productivity by 1.5%. (For more on this, read “Generative artificial intelligence: The next disruptive technology.”)

Who will be the beneficiaries of this boom? And where do investment opportunities lie? Most pure play companies developing generative AI-based platforms are privately held and supported by venture capital companies, which increased their investment in these firms from about $1.5 billion in 2020 to $4.5 billion in 2022, says Tagare. However, she adds, “there are other ways that investors can have exposure to generative AI.”

For example, publicly held companies that make complex, highly specialized electronic chips called graphics processing units (GPUs) are playing a critical role in the flourishing of this technology. “These chips are the heart and the brain of generative AI,” says Tagare. “You can’t have it without GPUs.” Despite their name, GPUs do far more than deliver graphics. These chips are capable of processing vast amounts of data—rapidly—and have other benefits that are helping to drive the generative AI revolution. Most production of GPUs comes from just a few companies.

In the technology sector, another likely beneficiary of the generative AI boom will be software companies that are incorporating these powerful algorithms into their products. The largest software makers and sellers of software are best poised to leverage generative AI since these systems must be trained on massive amounts of data to produce accurate content. “You need a lot of data to train generative AI for it to have high accuracy,” says Tagare. “And large companies have access to really large installed databases, so they will obviously be among the initial beneficiaries of generative AI.”

What other sectors benefit from AI?

What’s more, the growth of generative AI and related technologies will be a boon to a variety of other sectors. In health care, for example, hospitals are already implementing generative AI to automate tasks such as patient scheduling. However, generative AI could also promote efficiency and innovation at pharmaceutical and biotech companies, allowing them to rapidly analyze potential drug candidates, shrinking the time and cost of developing new medicines.

Banks and other financial institutions could also benefit from generative AI, notes Tagare. “At a minimum, it will help streamline interaction with customers,” she says. But there have also been reports of generative AI-based computer models assisting with investing portfolios. What’s more, generative AI is currently being implemented in supply chain management systems to improve planning and procurement, says Tagare, so its impact could be felt across a spectrum of industries.

Are guardrails needed?

How fast the generative AI market grows could be influenced by outside forces, of course. In particular, regulations created by governments to help protect against potential misuses of AI, such as the spread of misinformation and threats to national security, could hamper its development. Tagare points to a recent executive order by the White House and new regulations established in the European Union as examples of new guardrails on the development and use of AI.

“If regulation is too stifling, it could prevent significant growth of generative AI,” says Tagare. Overall, though, she’s optimistic about the potential of this transformative technology. “It has the power to change the way we work and could affect all parts of the economy,” says Tagare. “Generative AI is creating many new investment opportunities.”

Talk to your Regions Wealth Advisor about:

- The insights in this article and “Generative artificial intelligence: The next disruptive technology.”

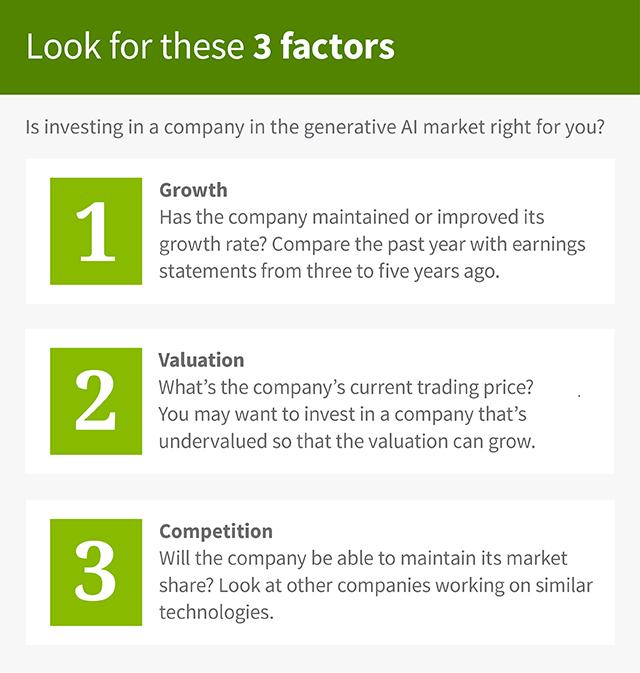

- Whether AI investments would be right for your risk tolerance and goals.

Interested in talking with an advisor but don’t have one?

Find a contact in your area.