Is it time to rebalance your fixed-income investments?

For investors who rely on their portfolio returns to meet their monthly spending needs, inflation has become a growing source of anxiety. It’s easy to see why. Inflation, which peaked in June 2022 with a 9.1% increase, the largest in 40 years, threatens to erode not only any potential income gains but also the value of portfolios.

Even with stubborn inflation, though, there is a silver lining. After years of rock-bottom interest rates and yields, things are finally turning around in the fixed-income markets. Taken together, inflation and rising yields paint a murky picture, and as an investor, you may be unsure what moves to make, if any.

Over the last 15 years, fixed-income investments generally offered meager returns compared to equity markets. “Investment managers popularized the term ‘TINA,’ which means ‘There Is No Alternative,’” says Scott Flurry, Director of Investment Strategy at Regions Investment Management in Birmingham, Alabama. “This basically meant that returns for bonds were so incredibly low that people were forced into equities. Equities were the only game in town.”

Now, though, there is an alternative, and many investors are warming to bonds. Flurry notes that the 10-year Treasury yield climbed above 4% in the fourth quarter of last year, and the Bloomberg Aggregate Bond Index yield is currently around 4.3%. In short, the bond market looks more attractive now than it has in well over a decade. Short-term bonds are also becoming an increasingly attractive option as the Federal Reserve continues to raise rates to combat inflation.

The bottom line? If your portfolio is still in TINA mode—meaning you haven’t rebalanced your stock-to-bond ratio in years—now might be a good time to reconsider your allocations. Consider the following asset classes.

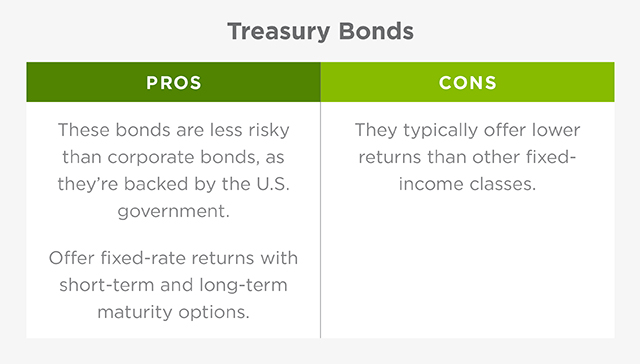

Treasury Bonds

Flurry calls federal Treasury bonds “the plain vanilla of the bond market,” but that doesn’t mean they’re unattractive. There is less risk involved, and they offer a fixed return, which is particularly useful for people who rely on their portfolios for their spending needs.

Short-term bonds, which provide a return in two years or less, tend to closely track the Fed’s activity. Since Flurry doesn’t think the Fed is done raising rates, he expects short-term yields to rise as well. He says it’s conceivable that two-year Treasury yields could reach as high as 5% in the near future.

Longer-term Treasuries require patience, as they operate on a horizon of 10 years or more. Rates for 10-year bonds incorporate a longer-term economic outlook, and they’ve begun moving lower. “The bond market is pricing in that the Fed is winning the battle against inflation,” says Flurry. “Longer-term yields are moving lower in anticipation of them winning that battle—and potentially even overdoing it and causing a recession or economic slowdown.” As a result, he expects long-term yields to stay in the 3% to 4% range.

“In terms of income generation,” Flurry says, “there’s a lot of value in the short end right now.” Meanwhile, those longer-term yields are incorporating the prospect of lower yields in the future, so they can offer some safety in terms of the income that you’re trying to predict. For this reason, Flurry recommends considering a combination of short- and long-term Treasuries.

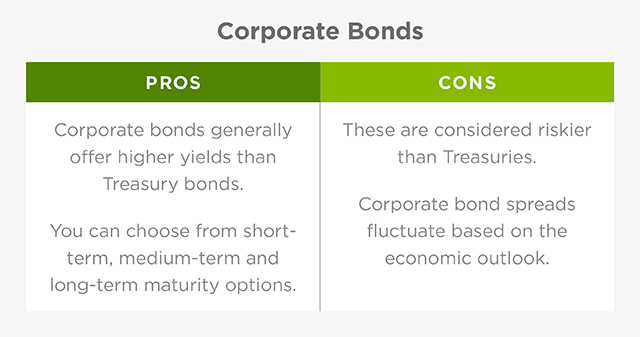

Corporate Bonds

Corporate bonds are considered riskier than U.S. Treasury bonds, so the creditworthiness of the company is important. This bond class offers numerous maturity options from short term (three years or less) to medium term (four to 10 years) to long term (more than 10 years). This allows investors to plan ahead and stagger their payout times.

When discussing corporate bonds, you’ll often hear the term “yield spread” used. This refers to the difference between the corporate bond yield and the similar maturity Treasury yield. Flurry explains, “Corporate spreads have been very low for a very long time, but in late 2022, the spread index peaked at about 160 basis points, and now we’re at 130. So we think corporate bonds do offer some value right now. Company balance sheets are good, and we’re not seeing in any kind of significant credit deterioration yet.”

He cautions, however, that spreads move with the economic outlook: “So if there is the potential of a Fed-induced recession, you might want to avoid longer-term credit bonds. But we certainly see in the short end of market that there’s some good value there, and you can generate higher income than you could with Treasuries.”

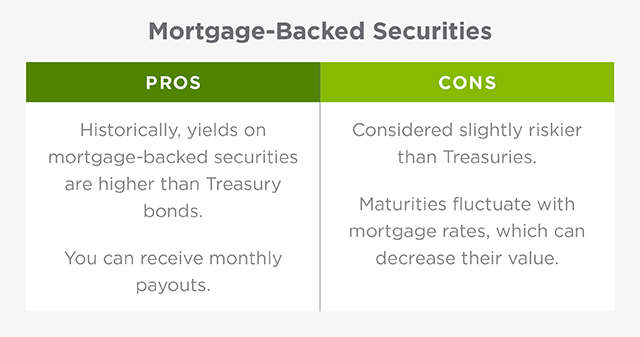

Mortgage-Backed Securities

After the subprime mortgage crisis of 2007–2008, many investors understandably shied away from mortgage-backed securities. But since the housing market recovered, lending standards have tightened, and mortgage-backed securities aren’t considered as risky as their reputation suggests.

While mortgage-backed securities generally offer a higher rate than Treasuries, Flurry says that 2022 was a bad year for them. “As interest rates climb, mortgage-backed securities extend in duration. That’s exactly what you don’t want in a bond portfolio. You have a fixed rate of interest that you’re earning on a bond, and the maturity of it extends, meaning you’re going to earn that back over a longer period of time, and the price of your bond goes down.”

Flurry adds, though, that mortgage rates appear to have peaked in 2022, making them a reasonably attractive component of portfolios moving forward. Another benefit of mortgage-backed securities is that they tend to offer monthly payouts rather than lump-sum payments upon maturity.

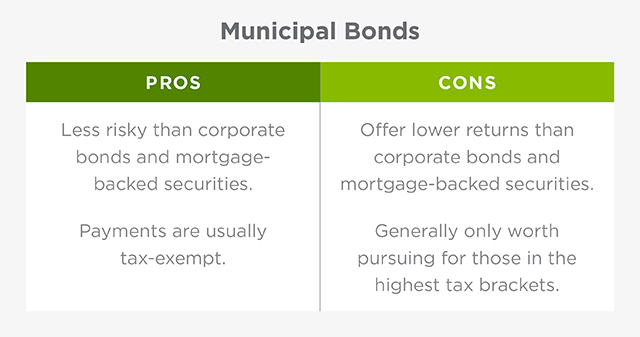

Municipal Bonds

Municipal bonds, or “munis,” are bonds issued by state and local governments, which they use to fund public works and infrastructure. Munis are generally considered safer than corporate bonds, but the trade-off is that they typically offer lower returns.

Looking at the big picture, Flurry notes that “with the influx of massive federal pandemic relief that we’ve seen over the past couple of years, municipal credit quality is really sound.” However, he adds that whether or not muni bonds are a good investment depends on their yields compared to Treasuries, corporate bonds and mortgage-backed securities.

“With the increase in attractiveness of corporate bonds and mortgage-backed bonds,” he says, “municipals don’t look as attractive as they have during the past few years.” However, because interest earned on municipal bonds is generally tax-free, this asset class could be a good investment choice for people at the highest levels of the income tax bracket.

Treasury Inflation-Protected Securities (TIPs)

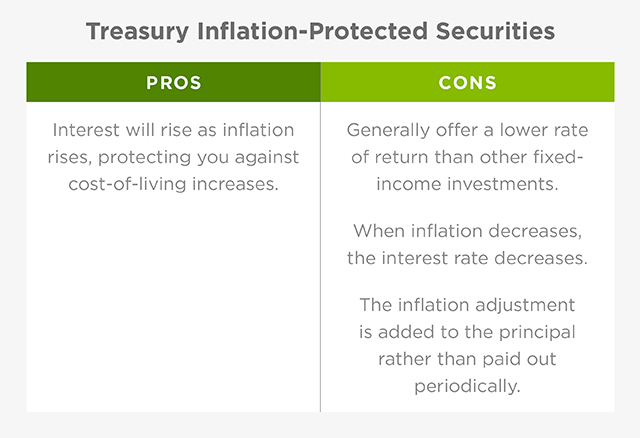

TIPs are yet another option to consider. Issued by the federal government, TIPs are indexed to inflation. “Your interest from a TIP floats depending on what the Consumer Price Index (CPI) does,” says Flurry. However, only a fixed portion of the income is paid out every six months while the CPI adjustment is added to the principal, which can be a drawback for those dependent on the income.

While a sure-bet hedge against inflation might seem like a win in today’s environment, Flurry is bearish on TIPs. “Lots of investors think that when the CPI is high like it is right now, that’s a good investment. We would say that’s not necessarily the case,” he says. “When the CPI is on the decline like it is right now, we believe that TIPs are most likely to underperform fixed-rate Treasuries over the near term as the Fed continues to take action.”

Goal Setting and Portfolio Construction

Generally speaking, many investors are overdue for a portfolio rebalance. Flurry says that over the last 15 years, the TINA mindset—investing heavily in equities and avoiding bonds—has prevailed. Old habits die hard, so many portfolios are likely to continue to rely heavily on equities, which financial advisors caution against as people near retirement age.

“If you were on a path—let’s say 15 years ago when you were 40, and now you’re 55—maybe you haven’t reallocated back to bonds,” Flurry explains. “Maybe you’re at 75% equities, and you should have been shifting that down, but it has been difficult to do because bond yields were so low. So I think getting back on your path of changing that asset allocation over your life cycle makes a lot of sense.”

Flurry reminds investors that trying to time the market is never a good idea. “With regard to market moves in a volatile environment, we always caution that investors really need to keep their eye on their goals and then sit down with a qualified investment advisor to plan your asset allocations.”

The important thing is to keep focused and reassess periodically with your Private Wealth Advisor. There are going to be times when your portfolio is outperforming and times when it’s underperforming. “Ask yourself if you’re still on track to meet your needs and don’t lose sight of your goals,” he says.

Talk to Your Regions Wealth Advisor About:

- Rebalancing your portfolio to account for inflation.

- How to develop and implement an investment strategy that fits your needs.

Interested in talking with an advisor but don’t have one?

Find a contact in your area.