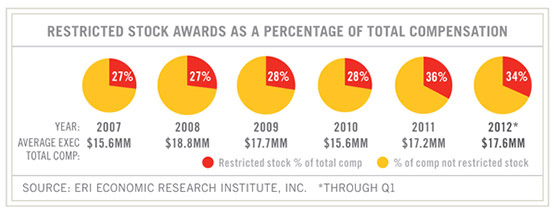

Corporate executives face unique challenges when it comes to diversification. Over the past five years, company stock has comprised a growing portion of executive pay packages, according to research from ERI Economic Research Institute, Inc.

This trend leaves many executives balancing the potentially negative public perception of selling insider shares against the increased risk that comes with having too much of their portfolio weighted in a single holding. Let’s look at four diversification strategies to consider:

Sell Through a Managed Account

Using a separately managed account provides two key advantages. First, the account manager can sell shares in predetermined lots, per month or per quarter, and reinvest proceeds into a diversified portfolio. This gradual distribution over a predetermined time period helps offset some of the negative public perceptions often triggered by sudden sales of big blocks of stock. Second, other areas of the portfolio may generate losses to help offset any taxable gains.

Build an Equity Collar

Another possibility is using stock options to create an “equity collar.” This is accomplished by simultaneously buying a long put and selling a short call on blocks of stock. A “put” is a contract that gives the owner the right to sell an investment at a specified price within a specified time frame.

A “call” is a contract that gives an investor the right to buy an investment at a specified price within a predetermined time frame. Using this strategy, you reduce the investment risk of price volatility by locking in both a ceiling and a floor for the trade. Depending on how the collars are structured, the price earned by selling the call offsets the cost of buying the put. Alternatively, they can be designed to generate excess cash.

Join An Exchange Fund

Sometimes called “swap funds,” these are limited partnerships made up of a pool of pre-qualified investors who each contribute large blocks of a single stock to the fund in exchange for fund shares. They provide investors with immediate diversification over the holding period, usually seven years, without generating a taxable event until fund shares are sold.

Establish a Charitable Remainder Trust (CRT)

Executives looking to make future charitable donations can move their company shares into a CRT, which creates an immediate income tax deduction and helps to diversify holdings without triggering a capital gains event. Stock in the trust can be sold tax-free, and the proceeds can be used to build a diversified portfolio. The contributor then receives an income stream from that portfolio through the life of the trust.

Want to Further Explore these diversification strategies? Your Regions Wealth Advisor can help you assess the options.