The Natural Resources and Real Estate group boasts experience that spans from forests to investment funds.

When one thinks of investments, financial assets such as stocks and bonds most readily come to mind. How investors apportion their portfolios between the two often comes down to their appetite for risk. To help preserve and grow their money, equities investors might hold a substantial amount of bonds, while bond investors seeking stronger capital appreciation might own a significant number of stocks. As the past few years have shown, however, stocks and bonds can be surprisingly correlated, making the case that portfolios should be diversified into real-asset alternative investments.

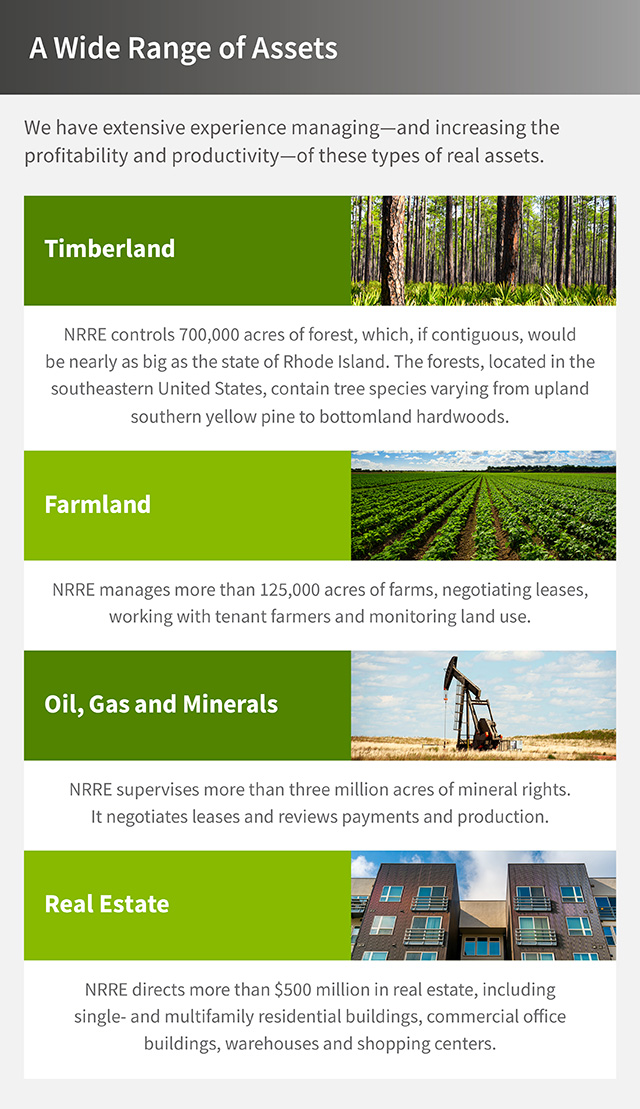

Real assets are less liquid than financial assets, but they are also less volatile, with steadier returns that are longer-term in nature than what an investor might see in the stock and bond markets. Real assets include timberland and farms, as well as oil, gas and other mineral rights, such as coal, gravel and rock. They also include both commercial and residential real estate.

None of these assets are easily purchased or managed as investments, but the professional foresters, geologists, landmen and property stewards in Regions’ Natural Resources and Real Estate, or NRRE, group can be an investor’s boots on the ground. The team’s property managers are as experienced getting their hands dirty in woods and fields as they are in their offices. They can negotiate contracts for clients and shepherd related investment funds.

“Our clients—trusts, individuals, corporations, family groups, universities and foundations—are located all over the United States,” says W. Keith Laenger, Manager of NRRE’s Forestry Asset Management team. Some, he says, have inherited the real assets, passed down for generations. Others have purchased them as part of their financial portfolios or recreational interests.

Either way, “we constantly seek to define our clients’ objectives in order to manage the properties. We’re here for anyone without the time, desire or background to properly manage the asset,” Laenger says.

A Rich Background in Trees

With 35 years of experience under his belt, Laenger exemplifies the depth and breadth of knowledge one can have about forestry. A native of northern Louisiana and a graduate of Louisiana Tech University, Laenger spent 17 years as the head forester for a large consulting forestry firm, managing nonindustrial, privately owned and trust timberland. He joined Regions in 2005, is a registered professional forester in Arkansas and a current member and past president of the Louisiana Chapter of the Association of Consulting Foresters.

Laenger’s tenure has been long at Regions, but he has a very modern skill set. For example, he’s a licensed remote pilot for small, unmanned drones, which he uses to evaluate swaths of timberland too extensive to review on foot or in his two conveyances, a four-wheel-drive truck and an accompanying all-terrain vehicle. The equipment is indispensable, as are the extra sets of clothes and boots he carries with him, which include snake leggings, as well as long-sleeved shirts to ward off the yellow jackets, wasps and mosquitos. In South Louisiana, alligators must be accounted for.

“Sometimes we come home kind of bloody from having to get through the trees and do things, but you just have to go with it,” he says.

What Does a Normal Week Look Like?

NRRE’s foresters spend a lot of time “off the road”—typically three days a week among the trees, conducting fieldwork. “Our days in the woods might include preparing a timber sale. That means performing a timber inventory, marking timber, refurbishing boundary lines and establishing streamside management zones,” says Laenger. “At the same time, we might be conducting a timber damage assessment for a utility right of way or inspections of timber harvest operations for contract compliance.”

And that’s not all. The art and science of growing trees—silviculture—ranges from entomology to forest economics, from inventory data collection to assessments of moisture, sunlight and the need for fertilizer. It involves geographic information systems technology that generates spatial maps, topography maps, aerial photography and other data-driven analysis to help the foresters manage the land.

If that sounds like a lot, it is. “The days in the field are long. We’re not stopping a whole lot for a sit-down lunch. But as foresters, we wouldn’t have it any other way,” Laenger says.

The two days a week the NRRE forestry team is in the office, their time is typically spent communicating with clients and timber buyers, reconciling timber payments, developing forest management plans and preparing timber sale bid packages, timber deeds and timber cutting agreements.

Communication skills are vital, and not just with the group’s clients. “We have to know how to speak to loggers and timber buyers, accountants and attorneys. We also rely heavily on our teammates here: the wealth advisors, the trust advisors,” he adds.

NRRE team members also have to easily recall numbers, staying on top of the timber market at all times, even if timberland asset market values are usually refreshed only every three years. Successions, estate planning and other client life events may demand more frequent land and inventory appraisals. The team’s frequent monitoring of the market also allows clients to take advantage of unexpected opportunities, for example, when abnormally wet weather adversely affects mill supply, driving up the price of timber for those tracts that can be quickly harvested and delivered.

Pooling Interests

While many NRRE clients own trees, farms and other real assets outright, there are other avenues into the sector. From time to time, the NRRE group offers a timber fund investment vehicle for accredited investors. An ideal holding would be a property with a mixture of mature, large trees that can be sold to generate income now as well as younger, smaller trees that will grow in size and value, says Ben Whitaker, a registered forester in Alabama who manages Regions’ timber funds out of Birmingham and assists a team of property managers with alternative uses for land, such as solar projects. With solar technologies becoming more common, carbon sequestration and solar farming are becoming viable options for some property owners.

“This kind of investment typically places investor capital into timberland properties in the southeastern United States, with potential capital appreciation and cash yield over an investment horizon of approximately 10 years,” Whitaker explains. “A timber fund could be a commingled fund with multiple investors that each hold a percentage of the overall investment, or a separate account held by a single entity.”

There are strong financial arguments for approaching real asset investing through the fund gateway, Whitaker says. For starters, the funds’ holdings are geographically diverse. And the funds offer economies of scale. “If you have enough property, then you could potentially sell timber every year and generate income every year,” he says.

In effect, the funds make it easy for interested investors to participate in real-asset investing, diversifying their overall portfolios from the usual financial assets. Or as Whitaker puts it: “For timberland properties that are vigorously growing, the trees continue to grow whether the stock market is up or down.”

Talk to Your Regions Wealth Advisor About:

- Whether diversifying into real assets is right for your financial goals and your portfolio.

- How Regions can help you manage the day-to-day needs of land or property you have inherited.

Interested in talking with an advisor but don’t have one?

Find a contact in your area.