How to communicate and build a legacy when lifestyles and ideologies clash within a family.

For many wealth creators, passing down their vision to the next generation is crucial. Yet, impressing their perspective on their heirs is often easier said than done. The rising generation was, because of their family’s wealth, likely raised with access to opportunities that the wealth creators never had themselves. These heirs won’t necessarily face the same challenges as their predecessors—or have the same mentality about work and money.

Yet a generation raised in the shadow of a powerful wealth creator faces its own challenges. To succeed, this generation needs both practical skills and a mindset of stewardship, which comes from careful communication and intentional leadership. “It’s not just about the numbers. It’s really about building a philosophy around money and wealth,” says Susan Rosenberg, Senior Trust Advisor with Regions Bank.

Wealth creators and family decision-makers—even those whose lives have been drastically different than their heirs—can secure their legacy by creating that philosophy of wealth and fostering a sense of stewardship in the next generation. Here’s how.

Normalize Regular Communication

The importance of clear and consistent communication in passing down your legacy cannot be overstated. Regular family meetings offer opportunities for wealth creators and family leaders to be explicit about how they built and maintained wealth, and to familiarize the next generation with the tools they need to succeed.

“As a best practice, set an agenda beforehand and prepare what you are and are not going to talk about in each meeting,” says Cindy Campbell, Senior Wealth Strategist at Regions Bank. “And remember that it is never too early to start talking to the next generation about stewardship.”

When family leaders and local Regions Wealth Advisors touch base in advance of meetings, the entire family is better poised to iron out intergenerational differences. Wealth creators, says Rosenberg, should focus on inclusivity and outreach.

“One of the families who excelled in this area had an annual meeting. Every family member was required to read a certain book and engage in mind-expanding exercises, which can help to get family members onto the same page,” says Rosenberg. “It doesn’t mean everybody is always going to agree with everything, but at least the seeds are planted for the next generation.”

Plan Ahead and Talk Out Major Issues

Consider a multigenerational family that didn’t see eye to eye on wealth transfer. The wealth creator had five grandchildren, four of whom did very well financially, while the fifth earned significantly less than his siblings. When it came time to discuss their inheritance, the sibling with the least financial stability assumed he was entitled to a larger inheritance.

“The family leaders met in advance to develop open-ended questions and plan for different scenarios where the individual might become defensive or upset. Then the wealth creator did a pre-call with her advisor before the meeting to determine what she was comfortable talking about,” says Campbell. “They didn’t want to talk about numbers or the size of the estate, but rather focus on the family’s philosophy and approach to wealth.”

By serving as a neutral sounding board, the Regions Wealth Advisor helped each generation see from different perspectives. During the family meeting, they were able to both recalibrate the grandson’s expectations and stay true to the wealth creator’s wishes.

Going forward, they created an ethical will, which can help transmit values from one generation to the next and facilitate estate planning. In an ethical will, says Campbell, “wealth creators can define their attitude toward wealth and what they want to instill in the next generation.”

Cultivate a Stewardship Mindset

Families that successfully maintain wealth across generations start by instilling a sense of stewardship in family meetings—and beyond. “As much as you can, bring them into the family’s business entity or philanthropic focus when they’re younger,” says Campbell.

“We all know there’s nothing that can replace the lessons learned from seeing—and participating in—leadership in action, both in business and in the community,” says Rosenberg.

Consider a family that owns and operates a business. Building leaders requires giving the upcoming generation a chance to observe the family business up close, so one wealth creator decided to put an external CFO in his place, rather than immediately hire his son. While working closely with the new CFO, the son learned the ropes and gained exposure, with hopes of eventually taking over the business. But if he didn’t earn the role and meet expectations, says Campbell, then the family would sell the business to somebody else.

“The big takeaway is that to set the next generation up for success, you want to let them try new things and branch out within constraints—whether that be a trust fund, seed money or a role with limited responsibility. You want to get them off the ground but not let them go too far afield,” says Campbell.

Be Open Minded to More Individual Paths

Sometimes that means letting members of the next generation forge their own path. That was the case for a wealth creator in the furniture business, whose son inherited his entrepreneurial spirit but didn’t want to follow in his footsteps. Instead, his father consulted with his financial team and opted to provide seed money so his son could pursue his dream of opening a restaurant. From there, it was up to him to make smart business decisions and put in the hard work necessary to succeed. Ultimately, the son’s business thrived.

“In a sense, you’re creating in the heir an artificial mentality similar to that of a wealth creator,” says Rosenberg. “They can take advice from the advisors, CPAs and attorneys, while also allowing their unique vision and passion to guide them—hopefully to success.”

Give Everyone a Voice

Consider a family who prides themselves on their philanthropic efforts, who wanted to pass down their vision for how important family giving is to them. They gave the younger generation a seat at the table by inviting all their grandchildren to participate in a pitch session. Each member of the rising generation chose a different charity and competed against one another by articulating how much they wanted to give and why.

“At the end of the day, the wealth creators probably gave to every charity. The point was that they wanted to instill in their grandchildren the importance of giving back. It’s this idea that this is not your money; you’re a steward of this money for the benefit of others,” says Campbell.

There are lots of personalities within a family unit, and coming to agreement requires clear intentions and hard work. If some family members are reluctant to talk about money, Rosenberg emphasizes that the consequences of failing to communicate can also be a powerful motivator. Without communication, secrets and assumptions can fester, which undermines the spirit of stewardship and can lead to the dissipation of the creator’s wealth within one generation.

“Sometimes, people will not force themselves to communicate unless they realize they will fail if they don’t,” says Rosenberg.

Plan With Guardrails

Many high-net-worth families employ various tools, such as trusts, family limited partnerships and family limited liability companies, which have the primary goal of protecting wealth. Charitable foundations, charitable trusts and other philanthropic vehicles are also helpful for generational wealth preservation while instilling values.

Setting up financial guardrails goes hand in hand with instilling a mindset of stewardship for the family’s hard-earned wealth, for the next generation and beyond. The vehicles provide family members the opportunity to learn and grow into their wealth while at the same time minimizing the risk of dissipation. Depending on the type of vehicle, they can also help propel younger family members to success while providing asset protection, because they can shield wealth from bankruptcy, lawsuits and divorce, for example.

Trust and advisor funds, which have the primary goal of protecting assets, are key tools to safeguard assets until the younger generation is ready to access them. Philanthropic tools, such as a donor-advised fund, in which participants select grants and charities, or private foundations, which are funded by an endowment from a single source, are common choices. Charitable trusts are another private option that preserve wealth, defer taxes, provide funds to the family and provide an opportunity for philanthropic community leadership.

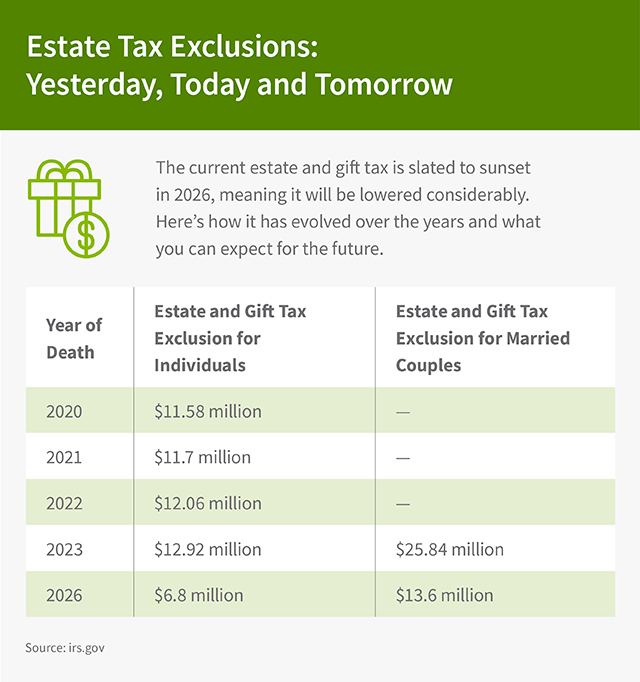

By offsetting taxable income, charitable donations also benefit the next generation. By teaching the next generation about these tools and including them in conversations with advisors, when appropriate, they’re also growing familiar with the importance of planning and management. And with the lifetime estate and gift tax exemption slated to be cut in half (and adjusted for inflation) in 2026, now is the time for wealth creators to think about optimizing their tax strategy for the benefit of future generations.

Keep Talking

The bottom line, says Rosenberg, is that very successful families start showing the rising generation the ropes early on. They communicate frequently and give the next generation boundaries without making them feel stifled. “It’s got to be ongoing,” she says. Campbell agreed, stating that “people might think wealth preservation planning is a one and done activity, but if we’re really talking about a strong plan and a strong shared vision, it’s got to be something that’s done on a regular basis. We typically engage clients in phases.”

Talk to Your Regions Wealth Advisor About:

- How you can create a family meeting that works for your family, and what tools are available to help you.

- What your goals are for your legacy—and how to successfully transfer your wealth and values.

Interested in talking with an advisor but don’t have one?