Do you have too much cash tied up in receivables, payables and inventory?

For small businesses, the working capital optimization cycle allows you to determine where your cash is tied up. And, if you know that, you can explore opportunities for making better use of it. “We’re seeing a lot more companies today focusing on optimizing their working capital than ever before,” says Jason Sweatt, Liquidity and Deposits Group Manager at Regions Bank. “We’ve found this to be a really good metric for companies that want a view into the health and long-term success of their businesses.”

The Nuts and Bolts

Working capital, also referred to as “cash conversion,” is measured by taking the difference between a business’s current assets and current liabilities.

The working capital optimization cycle is a way of looking at how your company handles its receivables, payables and inventory on a day-to-day basis. “The key objective in analyzing these three areas is to identify whether you can speed up your receivables and extend the duration of your payables, thereby creating opportunities to maximize the cash you have on hand and make the best use of it,” Sweatt says.

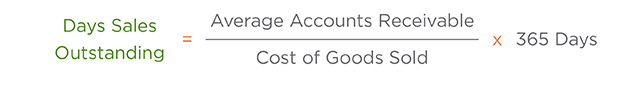

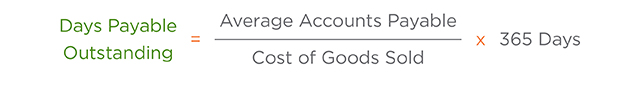

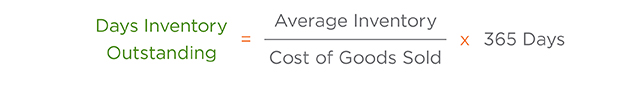

To calculate your working capital optimization cycle, you first need to determine three important numbers. These calculations will help.

Days sales outstanding is the measure of how long it takes for you to get paid. You can calculate it by starting with your average accounts receivable over a set period of time—such as monthly, quarterly or annually. With that figure in hand, divide your average accounts receivable by your sales and multiply that figure by 365 days.

Days payable outstanding is the measure of how long it takes for you to pay your vendors. You can calculate it by dividing your average accounts payable—which is also calculated either monthly, quarterly or annually—by your cost of goods sold and multiplying that figure by 365 days.

Days inventory outstanding is the measure of how long it takes to turn over your inventory. You can calculate it by dividing your average inventory costs, based on your preferred time frame, by your cost of goods sold and multiplying that figure by 365 days.

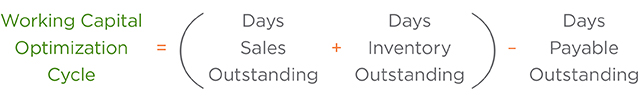

Once you’ve calculated these three numbers, you can determine your working capital optimization cycle by adding your days sales outstanding and your days inventory outstanding, then subtracting days payable outstanding.

For example, if a business has a days sales outstanding of 30, a days inventory outstanding of 60 and a days payable outstanding of 80, its working capital optimization cycle would be 10 days.

This number will vary depending on your individual business and industry. “Businesses should look at their working capital optimization cycle year over year to see how they’re performing over time and how they stack up to their peers,” Sweatt says. And if you’re looking for a benchmark, you can draw comparisons using the information for publicly traded companies that is available online.

For businesses that want to optimize working capital to increase cash flow, there are some important points to keep in mind. For starters, you want to get receivables in as fast as possible, and you do that by having a mix of treasury management services, such as having your clients pay you by automated clearing house (ACH) or wire. You can also offer a discount for clients who pay quickly.

On the payables side, you want to delay payments to vendors for as long as possible, unless they offer a discount for early payment that would offset not having the cash on hand. By hanging on to your cash for more time, you can use it to pay down your debt or invest. Meanwhile, how much inventory is on kept on hand varies depending on the business, but what’s critical is that each business manages its inventory efficiently. Lean manufacturing and just-in-time supplies are two popular inventory techniques to help with that.

Getting Cash in the Door Faster

What can businesses do in addition to using a mix of treasury management services? Bringing checks to the bank yourself takes time, while a method such as quick deposit allows you to deposit checks directly from your desk.

You can also use your bank’s lockbox service, whereby your financial institution deposits payments into your account to speed up payment processing and to lessen your bookkeeping workload. This provides access to funds a few days sooner than if you had taken the money to the bank.

Businesses where customers often pay with cash, such as gas stations, may also want to use an electronic vault service in which cashiers deposit money into an electronic vault. This allows you to streamline your cash handling operations by transmitting deposits electronically from each of your business locations, and it provides immediate access to funds.

Hanging On to Money Longer

While keeping your money in your accounts as long as possible is the goal, you should always pay your vendors on time. But the good news is that it’s possible to do so while also increasing your days payable outstanding. “Consider taking advantage of a corporate credit card. When you pay vendors with a credit card and then wait until the card’s due date to expend your own capital in paying it down, you’re staying on top of your bills while also holding on to your cash for as much as 30 days longer,” Sweatt says.

Better Health for Your Business

Not only does optimizing your working capital have near-term benefits, it can also help ensure the long-term health of your business. “Being on top of your cycle could potentially allow you to turn your cash into more cash. With more money on hand, you may be able to pay down debts, such as a line of credit,” Sweatt says. What’s more, you may want to invest those funds, enabling you to earn a rate of return on your cash instead of having it sit idle during the cycle.

As Sweatt explains, the benefits for companies that get it right accrue over time and can yield meaningful results. For instance, after his team at Regions Bank helped a business owner calculate their working capital optimization cycle, they noticed that year over year, the company’s receivables had slowed by 10 days. The business owner attributed the change to the economy’s impact on the business: Its receivable contracts had increased to 60 days net pay.

“My team suggested the business convert its checks to ACH, which would save it an average of $2.13 to process each check, saving more than $500 a month,” Sweatt says. “The ACH process also improved the working capital optimization cycle by delivering funds quicker and providing access sooner.”

Three Things to Do

- Learn more about how you can use supply chain finance to increase working capital.

- Speak with a Regions banking professional or relationship manager to learn how you can improve treasury management with integrated payables.

- To help prevent fraudulent activity, take advantage of Regions ACH Origination solution.